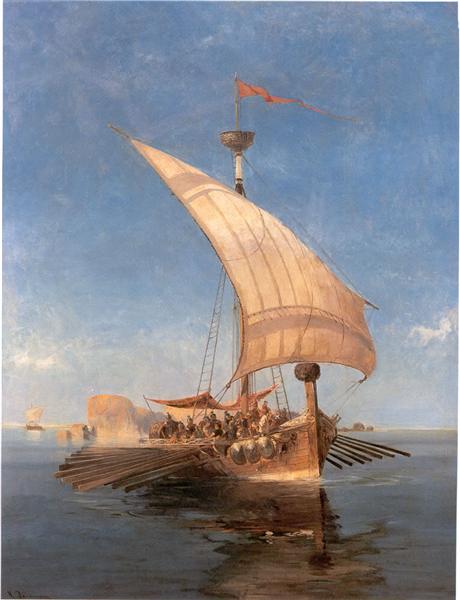

The Ship of Theseus

There is an ancient thought experiment centered on The Ship of Theseus. Greek Historian and writer Plutarch paints the scene based on Theseus, the King and founder of Athens. After many famous conquests on a ship, Theseus returns to Athens, where his ship becomes a museum piece. In the coming years, the ship receives repairs as time and decay begin to wear away at its wooden structure. After enough years have passed, every board on the ship has been replaced.

The question becomes, can this repaired ship still be considered the original Ship of Theseus? If every board has been replaced, is this now a fully different ship?

Since philosophers from Plato to Thomas Hobbes considered this a worthy thought experiment, I think it would be unwise for me to attempt to shed any light on the debate. Instead, this idea got me thinking about our work with clients.

Your Financial Life

Our goal when working with clients is to take the various components of their financial life and bring cohesion in a way that is unique to each of them. The passage of time and changes in life require that the components receive ongoing evaluation for repair or improvement. With enough time, perhaps all of the pieces will have changed.

Unlike the Ship of Theseus, there is no debate that the financial components of today may be unique and different than what a client originally selected years ago. That’s not only acceptable but expected. A thoughtful, comprehensive plan for a 30-year-old will look different after 10 or 15 years. That same individual may not have predicted how their priorities and risks would change when they added a spouse and a couple children to their personal balance sheet, and a new company to their financial balance sheet. Limited life insurance at age 30 was understandable, while today it may be a major risk.

The financial puzzle pieces are combined to meet current requirements and also anticipate future needs and goals. Some of those piece will age better than others. An estate plan may exist for decades without changes, but insurance on personal property may need to be evaluated every few years.

Time for a Review?

As you consider the unique components of your own financial life, are there any that could use a review? And how often should each component be evaluated? Since the answer, “It depends,” is a bit unsatisfying, let’s try to highlight a few questions to consider:

- Estate plan: Have your personal or financial circumstances changed since the plan was last updated? Have circumstances or relationships within your immediate or extended family altered how you would like your estate to be settled? Are the beneficiaries listed on your accounts in line with your wishes? Have recent legislative changes impacted your estate plan?

- Investments: Do you understand the risks currently being taken in your investments and are you comfortable with the risk level? This question will require an evaluation of your risk capacity and risk tolerance: how much risk do you want to take and how much do you need to take?

- Life insurance: Would your loved ones be financially supported in the event of your death? Alternatively, have you acquired a collection of policies over the years and wonder if they are all necessary?

- Personal property insurance: Have you recently reviewed the coverage and deductible levels? Has it been a number of years since you evaluated and received updated quotes to be sure you are properly covered at a reasonable price?

- Long-term-care insurance: Is the potential need for care in the future a risk you would rather minimize through insurance? Do you prefer to “self-insure” this risk?

- Retirement preparedness: Are you financially on track to retire in your desired time-frame? Do you know your options for healthcare coverage and the best time to begin claiming social security?

- Business ownership: Do you have a formal plan to sell or transition your business ownership? Does the plan meet your long-term liquidity needs? Have you made all the necessary adjustments to maximize the value of your business?

A review of these topics is very personal. We can’t answer if the restored Ship of Theseus is a new and unique ship, but we can assist in evaluating whether a financial update or repair is needed to meet your current and anticipated needs.

If we can be of any assistance, please feel free to reach out.

Author:

Thomas Burleigh, CFP®

Wealth Manager

Disclosure:

This post is not an offer or a solicitation to buy or sell securities. This may not be construed as investment advice and does not give investment recommendations. Any opinion included in this report constitutes the judgment of CMH Wealth Management, LLC as of the date of this report and are subject to change without notice.

Additional information about CMH Wealth Management is also available on the SEC’s website at www.adviserinfo.sec.gov. Past performance is not a guarantee of future results.

Photo credit: Argo, by Konstantinos Volanakis. WikiArt